Director-General Pascal Lamy, at the opening of the academic year of the Geneva Graduate Institute with Nobel Laureate Amartya Sen on 3 October 2012, said: "In his work Development as Freedom, Prof. Sen defines development as a process that expands human freedom and removes those 'unfreedoms' that leave people with little choice and few opportunities. International trade is recognized as a tool for generating opportunities for development. In this same spirit, the WTO does not advocate open trade for its own sake, but as a means for 'raising standards of living, ensuring full employment and a large and steadily growing volume of real income and effective demand'."

http://www.wto.org/english/news_e/sppl_e/sppl251_e.htm

Monday, 8 October 2012

IMF Managing Director Christine Lagarde Calls for Action Now to Secure Global Recovery

Christine Lagarde, Managing Director of the International Monetary Fund, today urged policymakers to use the window of opportunity offered by recent policy decisions - and to take the actions needed to achieve a decisive turn in the global crisis.

http://www.imf.org/external/np/sec/pr/2012/pr12358.htm

http://www.imf.org/external/np/sec/pr/2012/pr12358.htm

Growth to Slow in East Asia and Pacific in 2012, But Domestic Demand Will Play Key Role in Rebound Next Year

China's growth to slow to 7.7% in 2012 but recover to 8.1% next year

Singapore, October 8, 2012 - Economic growth in the East Asia and Pacific region may slow down by a full percentage point from 8.2 percent in 2011 to 7.2 percent this year , before recovering to 7.6 percent in 2013. Growth in developed countries will remain modest, with recovery in the region to be driven mainly by strong domestic demand in developing countries, said the World Bank in its East Asia and Pacific Economic Data Monitos, released today.

Marijuana Only for the Sick? A Farce, Some Angelenos Say

LOS ANGELES- One year after federal law enforcement officials began cracking down on California's medical marijuana industry with a series of high-profile arrests around the state, they finally moved into Los Angeles last month, giving 71 dispensaries until Tuesday to shut down. At the same time, because of a well-organized push by a new coalition of medical marijuana supporters, the City Council last week repealed a ban on the dispensaries that it had passed only a couple of months earlier.

http://www.nytimes.com/2012/10/08/us/california-fight-to-ensure-marijuana-goes-only-to-sick.html?hp&_r=

Friday, 8 June 2012

Rise in trade restrictions now ‘alarming’, Lamy tells WTO ambassadors

For the first time since the WTO started monitoring the protectionist reaction to the financial crisis in 2008, the scale of trade restrictions is a cause for “serious concern”, Director-General Pascal Lamy told an informal meeting of heads of delegations to the WTO on 7 June 2012. He also reported on latest developments in the Doha Round negotiations. This is what he said:

Thank you Madam Chair.

Since the May meeting of the General Council I have been consulting with Members on various occasions, including around the OECD Ministerial, during recent visits to Thailand and China, where I attended the LDC [Least-developed countries] accessions round table and the Global Services Forum, and this week in Kazan, Russia, where I held a number of bilateral consultations on the margins of the APEC [Asia-Pacific Economic Co-operation] Trade Ministers’ meetings.

The central message I have heard is that, given the deterioration of the global economic and trade outlook, 2012 cannot be a wasted year and that it is important that progress is made across the entire spectrum of our activities.

Let me start with the recent publication of our monitoring report on trade and investment measures taken in the crisis, which we do ahead of the G-20 meeting [in Mexico, 18–19 June 2012]. A report concerning measures by the entire membership will be sent shortly to all of you too.

For the first time since the beginning of the crisis in 2008, this report is alarming. The implementation of new measures restricting or potentially restricting trade has remained unabated over the past seven months, which is aggravated by the slow pace of rollback of existing measures.

The accumulation of these trade restrictions is now a matter of serious concern. Trade coverage of the restrictive measures put in place since October 2008, excluding those that were terminated, is estimated to be almost 3% of world merchandise trade, and almost 4% of G-20 trade. The discrepancy between the commitments taken and the actions on the ground add to credibility concerns.

This situation is adding to the downside risks to the global economy and what is now a volatile global context.

In such a situation, it is important that we collectively and urgently redouble our efforts to strengthen multilateral co-operation to find global solutions to the current economic difficulties and risks and avoid situations that would cause further trade and investment tensions. This will be part of the message that I will sharing with Leaders at the upcoming G-20 Summit on 18 June.

I hope that all Members can all live up to the commitment made by Ministersat MC8 [The eighth WTO Ministerial Conference in Geneva, December 2011] and elsewhere to keep markets open and resist protectionism in all forms. We also need to remain vigilant and begin to think about creative ways to improve our multilateral transparency and peers review. I would therefore urge that all Members engage in the consultations that the Chair of the TPRB [Trade Policy Review Body] will be undertaking to improve the WTO peers review of the monitoring reports produced by the Secretariat.

Another message which I will be conveying at the upcoming G-20 Summit is the importance of ensuring availability and affordability of trade finance. The Expert Group on Trade Finance as well as the Aid for Trade and Trade finance workshop which took place on 15 May stressed the importance of keeping multilateral development institutions engaged in trade finance, bearing in mind the development dimension of their programs. The permanent existence of a market gap for poor countries requires long-term public involvement, without which crisis intervention would be meaningless. With respect to regulatory matters, there was consensus that the dialogue with the Basel Committee should be usefully pursued on elements of Basel III regulation. Finally, it would be useful to encourage data collection on trade finance by both public and private sector.

The LDC accession roundtable which took place in Beijing last week, which was superbly organized, stressed the importance of completing LDC accession guidelines by July. I do believe such a move would bring greater confidence and trust in the ability of Members to address the specific needs of LDCs. It also saw the conclusion of the last outstanding bilateral deal for the accession of Laos to the WTO. Efforts need to redouble now to conclude remaining outstanding steps towards the accession of Yemen to the Organization.

On the DDA [Doha Development Agenda negotiations] front, and following up on the conclusions at MC8, all Chairs have been consulting with members in their respective areas. Let me focus on the areas where technical work has been on-going since our last meeting.

On trade facilitation, negotiations are continuing constructively at the technical level in line with the work programme agreed in the Negotiating Group in January. This week we have the latest cluster of facilitator-led negotiations, and a number of capital-based officials are in town to consult informally on areas of the text where they feel progress can be made and can then be fed back through the facilitator process into the Negotiating Group. Another cluster of facilitator-led negotiations will take place at the end of this month, to prepare for the next Negotiating Group session in July and the 13th revision to the draft agreement.

At the same time, suggestions have been made on the possibility of launching another needs assessment programme for developing countries and LDCs. This will of course need to be discussed in the Negotiating Group before any decision is taken, but it could help bring the element of resources needed for implementation into the equation in a concrete way and provide the basis for the essential matching up of S&D provisions [special and differential provisions for developing countries] with trade facilitation commitments in the new agreement.

In summary, progress is being made, it may not be as fast as some would like but given the technical nature of the work, and the importance all Members attach to the bottom-up, inclusive method of negotiations, there are no short cuts to be had.

On special and differential treatment, the CTDSS [Committee on Trade and Development special session] Chair has intensified the work and intends to hold weekly informal consultations for the next six weeks until the summer break, focussing on the three areas mandated from MC8 — the monitoring mechanism; the 28 Cancun Agreement-specific proposals; and the 6 Agreement-specific proposals. These informal consultations will be complimented by open-ended transparency meetings to take stock of work, including one such meeting to be held in July.

On the review of the Dispute Settlement Understanding, work has continued to progress — a sign that the Members value and understand the importance of dispute settlement to the System. The negotiating group has held four negotiating weeks since the beginning of the year, including this week. As a result, the group is close to completing the current phase of work, with a further set of meetings scheduled for mid-July. As part of the on-going work, a group of developing countries has recently presented a conceptual paper on issues of interest to them, which is a welcome development.

On the other DDA related issues, the level of activity has been lower, to say the least. While I believe that focusing on a number of development related areas is in line with the outcome at MC8, I believe it is time for the Members to also devote some attention to the other issues. And I do hope that today’s session will bring some clarity on how to do that. Since MC8 I have heard a lot of “talk” about new ideas and approaches. Maybe it is time we see a bit of “walk”.

Let me also briefly foreshadow the message that I intend to send at the upcoming Rio +20 meeting. I will stress, like I have in the context of food security that open trade is part of the solution to our collective sustainability challenges, not part of the problem. I will of course be reporting back to Members on these discussions at the General Council in July.

Let me before I close, draw to your attention two budgetary issues.

The first concerns delays in receiving Members contributions to the Global Trust Fund. Although the overall level of pledges made so far is satisfactory, the WTO’s ability to adequately plan and deliver on the technical assistance programme adopted by Members is negatively impacted by the delays in the receipt of the actual contributions. As you all know we cannot plan on the basis of funds we have not yet received. I would therefore like to urge Members to make every possible effort to ensure that their contributions are received by the Secretariat as soon as possible.

Finally, in the interest of transparency I would like to inform you that the Secretariat has begun carrying out a horizontal review of possible improvements in the area of translation, printing and distribution of documentation as well as in the organization of meetings and interpretation, in order to achieve the budgetary savings agreed with Members at the end of last year and that I will be reporting to the July Council on the state of implementation of the Decision.

This concludes my report to you.

Thank you Madam Chair.

Saturday, 2 June 2012

Drought Worsens in the Sahel Region of Africa – Millions of People at Risk

WASHINGTON, May 31, 2012—More than 17 million people are facing possible starvation in West Africa’s Sahel region, the zone skirting the southern portion of the Sahara Desert. The crisis is due to a combination of drought caused by poor rainfall in 2011, too little food, high grain prices, environmental damage and large numbers of internal refugees.

“Between 1998 and 2010, our harvests were flourishing and the livestock giving plenty of milk,” said Fatimata Diallo, head of a local farmer’s cooperative in the Mauritanian village of Toulel Dierri. “But since 2011, we are living very precariously.”

Mauritania, Niger, Mali, Chad and Burkina Faso are facing the worst of the crisis. The countries are experiencing stressed levels of food insecurity and many of their local coping mechanisms have been exhausted. The USAID Famine Early Warning System Network warns that between July and September 2012, the food security crisis will peak.

Emergency plans have already been put into place by the governments of Mauritania, Mali and Niger and the United Nations has launched its Consolidated Appeals Process, a tool developed by aid organizations to raise funds for humanitarian action. Other international efforts include more than €120 million allocated to emergency assistance from the European Union, global appeal campaigns from various Non-Governmental Organizations and the recent formation of the Global Alliance for Action for Drought Resilience led by the Intergovernmental Authority on Development (IGAD).

The World Bank Group is also adapting its projects to make the best use of existing assistance in the Sahel. Poor households in the worst-affected countries have immediate food needs and require additional humanitarian assistance.

“Droughts tend to have the worst affect on the poorest people in any given region; those with the least ability to adapt to changing climatic conditions,” said Jamal Saghir, director of the World Bank’s Africa Region Sustainable Development Department. “The drought in the Sahel is having an enormous impact on the poor and those displaced by conflict.”

Recent conflicts in Mali and Niger have forced over 300,000 people from their homes with many escaping to refugee camps in neighboring countries. The displacement has worsened an already difficult situation and has put many thousands more people at risk of malnutrition. Traditional animal grazing routes have been cut off and many local markets closed due to the conflict, which could have longer reaching consequences for regional food security.

In addition, the latest edition of the World Bank’s Food Price Watch warns that delayed harvests in the Sahel due to climatic conditions are contributing to flat or increasing food prices. Even if families were able to afford to purchase their own food rather than grow it, limited access to markets would impact accessibility, according to the report.

“With the rise in basic food prices, the precarious situation is gaining ground,” said another member of the Toulel Dierri food cooperative. “This year, we have even sent our girls into town to search for domestic work so they can at least have two meals a day.”

In just a short amount of time, according to the cooperative members, the community has gone from larger-scale agriculture to household subsistence agriculture.

What the World Bank is Doing

The World Bank is preparing to address short-term food security needs and long-term drought resilience in the Sahel region by conducting an extensive review of its existing programs in order to determine which resources from existing projects can be allocated to the crisis situation. This will help ensure that any needed resources can be allocated quickly and existing projects, especially those dealing with social safety nets, can be better tailored for longer-term drought resilience.

“Building resilience to drought is a key objective of our work,” said Doekle Wielinga, Head of the Africa Region Disaster Risk Management Team. “We are doing this by strengthening social safety nets which help households to bolster resources and build capacity to deal with climatic shocks. We are also financing agricultural development projects for improved and sustainable land management.”

Specifically, in Niger, the Bank is launching a community action project for climate resilience plus a large-scale social safety net project aimed at increasing access by poor and food insecure people to cash transfer and cash-for-work programs.

In Mauritania, a development program for irrigated agriculture is underway to increase food security by boosting sustainable irrigation and diversifying crops and agriculture for local farmers.

“Between 1998 and 2010, our harvests were flourishing and the livestock giving plenty of milk,” said Fatimata Diallo, head of a local farmer’s cooperative in the Mauritanian village of Toulel Dierri. “But since 2011, we are living very precariously.”

Mauritania, Niger, Mali, Chad and Burkina Faso are facing the worst of the crisis. The countries are experiencing stressed levels of food insecurity and many of their local coping mechanisms have been exhausted. The USAID Famine Early Warning System Network warns that between July and September 2012, the food security crisis will peak.

Emergency plans have already been put into place by the governments of Mauritania, Mali and Niger and the United Nations has launched its Consolidated Appeals Process, a tool developed by aid organizations to raise funds for humanitarian action. Other international efforts include more than €120 million allocated to emergency assistance from the European Union, global appeal campaigns from various Non-Governmental Organizations and the recent formation of the Global Alliance for Action for Drought Resilience led by the Intergovernmental Authority on Development (IGAD).

The World Bank Group is also adapting its projects to make the best use of existing assistance in the Sahel. Poor households in the worst-affected countries have immediate food needs and require additional humanitarian assistance.

“Droughts tend to have the worst affect on the poorest people in any given region; those with the least ability to adapt to changing climatic conditions,” said Jamal Saghir, director of the World Bank’s Africa Region Sustainable Development Department. “The drought in the Sahel is having an enormous impact on the poor and those displaced by conflict.”

Recent conflicts in Mali and Niger have forced over 300,000 people from their homes with many escaping to refugee camps in neighboring countries. The displacement has worsened an already difficult situation and has put many thousands more people at risk of malnutrition. Traditional animal grazing routes have been cut off and many local markets closed due to the conflict, which could have longer reaching consequences for regional food security.

In addition, the latest edition of the World Bank’s Food Price Watch warns that delayed harvests in the Sahel due to climatic conditions are contributing to flat or increasing food prices. Even if families were able to afford to purchase their own food rather than grow it, limited access to markets would impact accessibility, according to the report.

“With the rise in basic food prices, the precarious situation is gaining ground,” said another member of the Toulel Dierri food cooperative. “This year, we have even sent our girls into town to search for domestic work so they can at least have two meals a day.”

In just a short amount of time, according to the cooperative members, the community has gone from larger-scale agriculture to household subsistence agriculture.

What the World Bank is Doing

The World Bank is preparing to address short-term food security needs and long-term drought resilience in the Sahel region by conducting an extensive review of its existing programs in order to determine which resources from existing projects can be allocated to the crisis situation. This will help ensure that any needed resources can be allocated quickly and existing projects, especially those dealing with social safety nets, can be better tailored for longer-term drought resilience.

“Building resilience to drought is a key objective of our work,” said Doekle Wielinga, Head of the Africa Region Disaster Risk Management Team. “We are doing this by strengthening social safety nets which help households to bolster resources and build capacity to deal with climatic shocks. We are also financing agricultural development projects for improved and sustainable land management.”

Specifically, in Niger, the Bank is launching a community action project for climate resilience plus a large-scale social safety net project aimed at increasing access by poor and food insecure people to cash transfer and cash-for-work programs.

In Mauritania, a development program for irrigated agriculture is underway to increase food security by boosting sustainable irrigation and diversifying crops and agriculture for local farmers.

Monday, 28 May 2012

World Bank Database Shows Export Markets Are Dominated by Big Firms

Difficult for Newcomers to Survive

WASHINGTON, May 24, 2012 – A few large companies dominate export markets in developing and developed countries, with the top one percent often accounting for more than half – sometimes nearly 80 percent – of total exports, according to a new World Bank database with a wealth of details on exporting firms.

The new Exporter Dynamics Database offers the most comprehensive picture yet of exporter characteristics and dynamics – a firm’s entry, exit and survival in the export market – in 45 developed and developing countries. The database mainly covers 2003-2009, though data from the 1990s are also available for some countries.

A key finding is that the export market is difficult to tackle for newcomers, with 57 percent of companies on average – and two-thirds in Africa – quitting within a year of entering the export market.

“Governments traditionally have focused on helping exporters expand to new products and new markets, but they may need to do more to help firms survive,” says Ana Margarida Fernandes, the task leader of the database, which was developed by the Trade and International Integration team of the World Bank’s Development Research Group.

The global database allows for cross-country comparisons of exporters based on factors such as size, survival, growth, and concentration. More countries will be added as the database expands. Until now, most databases focus not on exporting firms, but on the aggregate flow of goods across borders based on countries or products.

Based on data sets covering the universe of export transactions obtained directly from customs agencies, the data are comparable across countries. Measures cover the size distribution of exporting firms, their diversification in terms of products and markets, the dynamics of exporting firms’ entry, exit and survival, and the average unit prices of the goods traded.

The Exporter Dynamics Database could help policy makers identify opportunities in particular sectors and address challenges faced by their exporters, especially in their entry and survival in export markets. For example, it can be used to analyze the performance of export sectors in a country, comparing them with their counterparts in the region or richer countries. The database can also make it easier to analyze the impact of tariffs and other trade barriers. For example, it can be used to assess the impact of stringent non-tariff measures on the numbers and average size of exporters.

The database reveals several interesting trends. For example, the rate of firms entering the export market is high, with more than half of the exporters in Laos, Malawi, Tanzania, and Yemen being newcomers in any given year. But their survival rate isn’t that good, generally with more than a third of companies on average leaving the export market every year.

“Our database shows how large the degree of churning in export markets is, particularly in less developed and smaller economies,” says Martha Denisse Pierola, an economist at the Development Research Group who started the project with Caroline Freund, now the chief economist at the Middle East and North Africa Region of the World Bank. “We need further research to better assist governments in minimizing the costs associated with these high exit rates.”

Thursday, 24 May 2012

Paul Krugman on Euro Rescue Efforts

'Right Now, We Need Expansion'

In a SPIEGEL interview, Nobel Prize-winning economist Paul Krugman argues that this is not the time to worry about debt and inflation. To save the euro zone, he argues that the European Central Bank should loosen monetary policy and the German government should abandon austerity.

SPIEGEL: Mr. Krugman, does Greece have to leave the euro zone?

Krugman: Yes. I don't see too much alternative now. It's going to be terrible in the first year if they do leave. So I am really reluctant to say that it's a little bit like shouting "Fire!" in a crowded theater, but what is the realistic option here? It's not as if anything anyone's proposing has any hope at all of getting them out of the mess they're in.

SPIEGEL: If Greece should leave, will this finally contain the euro crisis or, rather, make things worse?

Krugman: What happens if Greece leaves? Then you have again a bank run in other peripheral countries because they've set the precedent. But, again, that could be contained with lending from the ECB (European Central Bank). What has to happen is that the ECB has to be willing to replace all euros withdrawn as is necessary. And I think the case we're making for that lending becomes a lot easier because the Greeks were actually irresponsible. The Greeks actually did behave badly, and so the political case for unlimited exposure to Greece is very hard to make. A much easier case to make is for Spain and then Portugal and Italy, all of which did nothing wrong on the official side. So you could argue that the bad actor has been ejected, but we need to save the good actors.

SPIEGEL: But is the ECB ready to act in the way you propose?

Krugman: That's the mystery, right? We will see a big flood of money out of Spanish and Italian banks, and then the ECB has the choice to accept a big increase in its exposure to those countries. The ECB lending that much money with ultimately the Bundesbank on the hook for a lot of it -- that seems impossible. But if you say, well, the ECB won't be willing to do that, then the euro blows apart. And allowing the euro to fail -- that's impossible. But one of those two impossible things is going to happen.

SPIEGEL: Could Europe have avoided the current situation with more decisive actions early on?

Krugman: Greece was probably a doomed prospect from the moment that we got the truth about their budget. Spain, which is really the epicenter, is still savable.

SPIEGEL: In your columns, you have repeatedly criticized Chancellor Merkel for her management of the European crisis. Do you blame her for the situation we are in right now?

Krugman: She has certainly drifted; she has temporized. Could she have done more? I don't know. I just have the feeling that we really are looking at the gears of fate grinding along.

SPIEGEL: But you have repeatedly pointed out that Germany's pushing for austerity will lead Europe on a death trip and that prosperity through pain is a fantasy.

Krugman: That's right. I thought it was obvious from the beginning that this is never going to work. If the policy makes any sense at all, it's through mass unemployment, driving down Spanish wages. How many years is that supposed to take given that we've seen that, even with close to 25 percent unemployment, you will have a glacial pace of wage adjustment?

SPIEGEL: You call austerity a "zombie" economic policy.

Krugman: Yes, the whole point about zombies is that they just keep on champing forward no matter how many times you think you have killed them. We've got really almost two and a half years of experience with how these policies actually work, and the fact that this is still the recipe that is being preached despite all the evidence that they are not working.

SPIEGEL: Doesn't it just take some time for the austerity measures to deliver results?

Krugman: Where's the evidence?

SPIEGEL: Greece's economy grew in the first quarter.

Krugman: That's possible. Greece has actually achieved some improvement in cost competitiveness. But think about how long it would take to fully restore. The thing about unemployment at these levels is that the damage is cumulative. People's lives are being destroyed as their savings run out.

SPIEGEL: So you think we should go the other way and spend our way out of trouble?

Krugman: Any individual country, except Germany, doesn't have this option. It's not as if the government of Spain can simply reverse and go to Keynesian policies. They can't fund that. Put it this way: If you're the prime minister of a small European country, even a fairly big one like Spain, you have no option. Your options are to have some form of austerity, possibly while protesting, or simply to leave the euro. But Frankfurt and Berlin have choices.

SPIEGEL: What do you want the ECB and the German government to do?

Krugman: First of all, give the green light to the ECB and say: Price stability is the mandate, but it's not defined. So the reality is we're going to need to see 3-plus percent inflation over the next five years. No more tightening, no more raising interest rates at the first hint of inflation, even if it's obviously a commodity blip. If anything, cut interest rates. Open-ended lending to governments and banks.

SPIEGEL: And Berlin ...

Krugman: ... should not be doing austerity in Germany. I'm tempted to add that I wish for all of that and a pony as long as we're wishing for things we don't expect to get.

SPIEGEL: And maybe that's a good thing. Because 4 or 5 percent inflation may be fine for a short while, but how do you make sure that it doesn't rise to 7 and 8 percent or more once the expectation is there?

Krugman: It's not actually hard. Just raise interest rates once it's creeping up to the level you don't like. I mean, people have the notion that inflation just explodes out of nowhere. It just isn't true. It just hasn't happened. If you actually look at the histories of the inflations that we've had, hyperinflations come from a very different story. They come from governments that can't raise revenue and just rely on the printing press.

SPIEGEL: But if inflation really isn't that big of a problem, why is everybody so afraid of it?

Krugman: For one, it's that central-banker culture. Central bankers almost define themselves that way. Their job is to take away the punchbowl just as the party really gets going. And, in the current circumstance, they seem to be eager to take away the punchbowl even though there isn't any party to begin with. Plus, in Germany, you have this weirdly lopsided historical memory where everyone remembers 1923, everybody remembers Weimar. And nobody remembers Chancellor Brüning (Germany's chancellor from 1930 to 1932, who pushed austerity measures).

SPIEGEL: The US has followed a looser monetary policy for about 10 years now, but the debt problem is still there.

Krugman: We do not have a current federal debt problem. We have a private-sector debt problem. But, if you say the US has been more inflationary, if you actually look at average inflation rates over the past 10 years, they're not very different between the euro area and the United States. They've both been in the two-ish percent range.

SPIEGEL: So you would say that, in Europe, it's the ECB that needs to act and, in the US, it's government stimulus that is really needed to get things going?

Krugman: If there was a European government, I'd be arguing for stimulus from that European government. But Europe has a special problem, which is the single currency without the single government.

SPIEGEL: So, if you could have a stimulus in Europe, how much money would you need?

Krugman: Again, the US and Europe are not that different. I would say a similar number, and that's 300 billion. So we're not talking trillions of fiscal stimulus.

SPIEGEL: What do you think about the growth programs that are currently being discussed within the European Union? Are they enough?

Krugman: This is a water pistol against a charging rhinoceros. This is ridiculous. These are ludicrous, trivial things compared with the scale of what's going on.

SPIEGEL: Still, we aren't really sure that the almost $800 billion in the US really worked.

Krugman: First of all, 40 percent was tax cuts, some of which were tax cuts that were actually already baked in, so it wasn't real. It was actually 700 real, of which a large part was still tax cuts. Then, if you want to think about it, it's over a roughly three-year period. It really was not a big deal if you look at government spending in aggregate, state and local as well, where there was no stimulus at all. There was a rise in spending on food stamps and Medicaid and unemployment insurance -- but those are responses to the crisis, not new programs. So the answer to the question of why stimulus didn't do more here is: What stimulus? We never had them.

SPIEGEL: More stimulus also means more debt. Many European nations, as well as the US, are already drowning in debt.

Krugman: I'm not saying that I don't ever care about debt, but not now. If you slash spending, you just depress the economy further. And, given the low interest rates and what we now know about long-run effects of high unemployment, you almost certainly actually even make your fiscal position worse. Give me a strong-enough economic recovery that the Fed is starting to want to raise interest rates to head off inflation -- then I become a deficit hawk.

SPIEGEL: So, for now, we should just ignore the huge debt burdens?

Krugman: That's right. It's quite amazing that we're giving priority to the imagined threat that the bond markets might lose faith even though they give every indication of not being worried at all, given the reality that millions of people have been unemployed for more than a year and the almost certain long-term damage that that's inflicting.

SPIEGEL: But we can't just kick the debt can down the road and let future generations deal with it. The debt has not been shrinking even in good economic times.

Krugman: That's not true. We went into huge deficits when the economy plunged, and this is the time for huge deficits, not later. And it's not a date; it's a condition. When the economy has recovered sufficiently so that we're no longer in the liquidity trap is when you start to worry about debts again. John Maynard Keynes said: "It's the boom, not the slump, that is the time for austerity." And we're definitely not in the boom yet.

SPIEGEL: In your new book, you are actually saying that we are in a depression.

Krugman: I'm using the term advisedly. It's not as bad as the Great Depression. But the standard language of recession and recovery is actually harmful here because it makes you think that, because we're not actually in a recession, things are okay. But they are not. Depression is a period of high unemployment, of really lousy conditions -- and that describes us right now.

SPIEGEL: So, are we looking at a lost decade in the West similar to what happened in Japan?

Krugman: In fact, we're doing worse than the Japanese every day. We are actually having a steeper slump, more suffering, larger output gaps than the Japanese ever suffered. Those of us who were writing critically about Japanese policy 10 years ago ought to all go to Tokyo and apologize to the emperor. Not because their policy was any good -- their policy was terrible -- but our policy is even worse.

SPIEGEL: What has almost been forgotten in recent months -- over all the criticism of the political crisis-management -- is the role that banks have played in the crisis. News about the heavy trading losses of JP Morgan has brought this back into the discussion. It seems like nothing has changed on Wall Street.

Krugman: The Volcker Rule is not yet in effect. I think that, if that had been in effect and defined, it might have stopped this. Hopefully, this turns out to be the last gasp of banks behaving in ways that they will not be allowed to in the future. (JP Morgan Chase CEO) Jamie Dimon is saying he will not, in fact, budge from his antiregulation position at all.

SPIEGEL: But the issue of banks being too big to fail has yet to be adequately addressed.

Krugman: A lot of the banking problem is not too big to fail. Lehman wasn't all that big. But there is clearly more of a political-economy problem of too-big-to-fail banks, which is that they get too powerful and are in a position to undermine reform. The problem with JP Morgan ... is not as much that they are too big to fail as the fact that they are so damn big that they can probably continue to drive a watering-down of financial reform even though they just messed up so badly.

SPIEGEL: But aren't banking issues to some extent a by-product of loose monetary policies? That was one reason for the financial crisis in 2008. Even now, having central banks pour money into the system could lead to new financial bubbles, which could trigger new problems within the financial system if they were to burst.

Krugman: I am not convinced that excessively loose monetary policy was actually at the root of the problem in the first place. And then, even to the extent that you think that excessive optimism or exuberance got us into the crisis -- and, therefore, we must be very careful to avoid anything like that ever again -- that's fighting the last problem. Right now, we need expansion.

SPIEGEL: The European banks are already in trouble.

Krugman: What's actually happened now is that a lot of the European banking system is basically heavily invested in the sovereign debt of its own countries. And so it's all tied together. I'm not worried about European banks; I'm worried about Europe. If the euro survives, then so will the banks.

SPIEGEL: Shouldn't the close ties between banks and sovereign debt be cut?

Krugman: You can't cut now. There's a fire, and we need to pour as much water on the fire as possible. Let's worry about reconstruction afterwards.

SPIEGEL: Mr. Krugman, thank you very much for your time.

The interview was conducted by Martin Hesse and Thomas Schulz

Wednesday, 2 May 2012

Tuesday, 13 March 2012

Why do successful companies keep investing in ongoing marketing?

Seasoned Fortune 500 companies have a deep understanding and appreciation for marketing. Coca-Cola may already one of the most recognized brands in the world, but they nevertheless spend billions of dollars every year on their marketing efforts. (And you can bet they’re not doing it on a whim. They know exactly what those dollars will bring them in return.)

On the other side of the spectrum, startups and micro-businesses view marketing as a matter of survival, not theory: their business will disappear if they don’t invest in it.

Between those two extremes, however, an interesting thing often happens: companies forget about marketing. Once a company gets past a few million dollars in revenue, it’s tempting to let things slide. Some of these companies stop marketing altogether.

Business is growing and everyone’s staying busy, they think, so why bother with the expense and hassle?

I’ll tell you why.

Marketing is food, not medicine

Inexperienced companies regard marketing as medicine to be taken when something is wrong. (“Not enough customers? Take some marketing and call me in the morning.”)

This is completely wrong-headed thinking, and it’s one of the reasons so many otherwise successful businesses wind up failing. They get used to feeling busy…until they realize it’s too late to start what they should have been doing all along.

Marketing is food. It’s the regular, sustained nourishment that gets your business where you want it—and keeps it there. You need it throughout the day, every day.

Peter Drucker, one of the leading experts on management theory, wrote:

Because the purpose of business is to create a customer, the business enterprise has two—and only two—basic functions: marketing and innovation. Marketing and innovation produce results; all the rest are costs.

He also wrote:

Marketing is not only much broader than selling; it is not a specialized activity at all. It encompasses the entire business. It is the whole business seen from the point of view of its final result, that is from the customer’s point of view. Concern and responsibility for marketing must therefore permeate all areas of the enterprise.

This perspective is what keeps Fortune 500 companies so intense about sustained, well-funded marketing—even when they’re already successful by any measure.

While inexperienced businesses wait until they’re starving to start looking for nourishment, these savvy enterprises eat regular, healthy meals throughout the day, keeping them strong and thriving year after year.

Successful companies never stop marketing

Here are four common-sense reasons why the most successful companies in the world engage in vigorous, ongoing marketing efforts:

Ongoing marketing prevents “reputation rot”: If you surveyed everyone who’s heard about your company, you’d probably find that their understanding of who you are and what you do is out of date by at least a few years. Your company is constantly improving, but people’s perceptions tend to remain fixed. Every year that passes brings them further and further out of sync, until hardly anyone actually understands what your company has become. It takes years to shape and define your reputation, so you need to be doing it all the time. You can’t wait until it’s hopelessly out of sync, and only then start the arduous process of convincing everyone you’ve changed. (If you do, you’ll never make it to the other side.)

Ongoing marketing shapes your customer base: As your company evolves, your company will need to target different audiences. Sometimes your focus changes only slightly, and other times you have to start with a completely new customer base. Either way, you need to be constantly evaluating your target and adjusting your messaging, visuals, and strategy according.

Ongoing marketing gives you lots of options: Having “just enough” business isn’t enough. If you’re actively marketing, there should always be more demand for your offering than you can actually meet. This gives you the option to pick and choose your customers, to focus on the most profitable (or most enjoyable) ones, and to have a waiting list ready for when times get slower.

Ongoing marketing secures your company’s future: The single most important reason for engaging in active, ongoing marketing is simply that it secures your company’s future. Marketing creates business. You may have lots going on right now, but will it still be there in six months? A year? Three years? Savvy business owners don’t leave their future up to chance; they’re planting seeds now they can harvest next season.

If your company currently has lots of work, happy customers, and a busy staff, then you’ve successfully achieved a key milestone in the life of a business: viability. This isn’t the end of your journey, though, but the beginning — and marketing will be your constant companion at every step you take from here on out.

Monday, 12 March 2012

Businessmen Who Broke The Rules (And Some Laws)

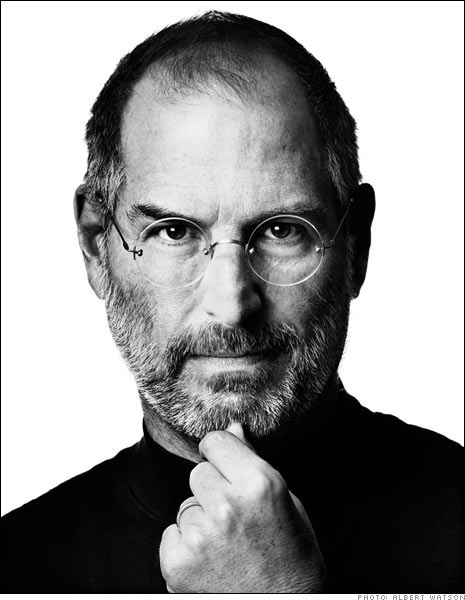

1. Steve Jobs

Co-founder of Apple and chairman of Pixar, Steve Jobs towers over Silicon Valley as a renegade and artist as much as a business manager. Fortune magazine calls him a “global cultural guru,” responsible for changing the way the world works and plays. Yet, he has been criticized for his superior attitude, taking credit away from his subordinates, micro-managing his business, firing employees in fits of anger, and any number of minor infractions, such as parking his Mercedes in handicapped spaces. His net worth is estimated to be over $20 billion.

2. Sam Walton

At the end of his autobiography, Made in America, Sam Walton wrote that the most important rule in business is to break all the rules. He has also said, “I always prided myself on breaking everybody else’s rules, and I always favored the mavericks who challenged my rules.” His innovative and daring approach to business established the worldwide Wal-Mart chain, which replaced Exxon as the largest corporation in the world in 2002.

3. Bill Gates

It is common knowledge that the richest man in the world is a college dropout. Instead of completing his education at the prestigious Harvard University, Bill Gates decided to take a risk and devote himself fully to a little business called “Microsoft” he co-founded with a classmate, Paul Allen. Not content with the prevailing open-source practices of software development, Gates decided to buck the system by demanding a closed-source ethic. By changing the rules of software development, he established the software industry as we know it today.

4. Donald Trump

A self-made billionaire, real estate mogul Donald Trump is widely regarded as a man who makes the rules. And among Trump’s rules for success, you will not find the words, “humility,” “generosity,” “sympathy,” or “compassion.” The quintessential bullying boss, Donald Trump is a cultural icon and one of the most famous people in the world. Comparing publicity photos from his early years of fame with his more recent dominance on the world’s stage, it is clear Trump has cultivated a distinctly mean image. It is possible he still enjoys smiling, but apparently it is no longer marketable. While nobody is questioning his head for business, Trump’s fame, if not his fortune, is less attributable to any specific business deals or professional decisions than to his “mean boss” imagine and his high-profile personal life (including his widely publicized divorce from Ivana Trump and his scandalous sex life with Slovenian supermodel, Melania Knauss, who would become his wife).

5. Henry Ford

The father of the modern automobile, founder of the Ford Motor Company, and inventor of the moving assembly line was a highly unconventional business leader. Henry Ford challenged his times (and his investors) by insisting on producing affordable automobiles for a mass market. He paid his employees much more than was common at the time, creating what he called “wage incentive” and thereby attracting and keeping a strong work force. Advocating “welfare capitalism,” Ford took an unusual amount of interest in the lives of his employees, requiring them to live according to the rules set by his “Sociological Department,” which restricted how they spent their leisure hours. His risks paid off, and Ford Motor Company has helped define the modern urban landscape.

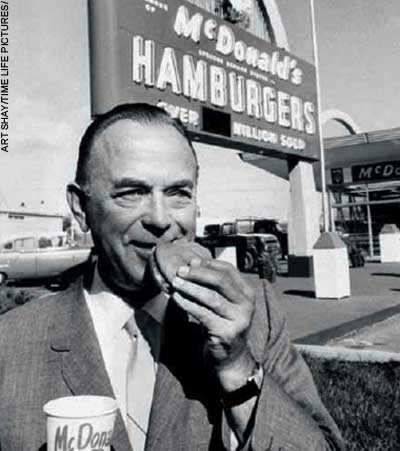

6. Ray Kroc

Ray Kroc did not open the first McDonald’s restaurant. He just turned a small, family-owned drive-in into a multi-billion-dollar global franchise. Like Henry Ford before him, Kroc’s ingenuity was in finding a way to bring high quality goods to a mass market. He revolutionized the restaurant industry by introducing strict guidelines for how his items were produced and sold. He turned the sale of hamburgers into a science, and even had his franchise owners earn a “Bachelor in Hamburgerology” at McDonald’s training institute. Unlike Ford, however, Kroc has been criticized for paying his employees as little as possible, and has been accused of trying to circumvent minimum wage laws.

7. Michael Dell

Widely regarded as one of the most important innovators of the computer industry, Michael Delldefied convention by cutting out the middle man and selling PCs directly to consumers, allowing them to custom order machines by phone and mail. A college dropout, he is now one of the world’s top three PC manufacturers and one of the richest men in the world. (If you compare their net worths, it looks like Dell could buy 6 or 7 Donald Trumps.) Some of his competitors have coveted his unique business model, but without matching his success. He has won such accolades as “Man of the Year” by PC magazine, “Top CEO in American Business” by Worth, and “Entrepreneur of the Year” by Inc. magazine. Dell.com is one of the largest consumer e-commerce sites on the Web

8. Roman Abramovich

Sometimes called the “quiet oligarch,” Forbes’ 15th wealthiest billionaire has always kept a closed lid on his affairs. A Russian oil magnate and owner of the Chelsea Football Club, Roman Abramovich has impressed the world with his daring and often surprising business decisions. Despite accusations that he has made his fortune by exploiting the malaise of others, Abramovich has been honored as Russia’s “Man of the Year” by Expert magazine and was awarded Russia’s Order of Honor for his charitable work developing the region of Chukotka, for which he has also been a representative and governor. Abramovich was making multi-billion-dollar business deals before his 40th birthday. He has admitted to spending billions of dollars on political favors.

Source: http://www.businesspundit.com/25-businessmen-who-broke-the-rules-and-some-laws/

How Procter & Gamble Designs Change

Procter & Gamble (PG) is a 175-year-old company that’s working hard to smooth those corporate age wrinkles. And it’s getting help from an eight year old corporate initiative that’s been pushing change since its former CEO, A.G. Lafley, decided in 2001 that P&G needed to get good at design-thinking.

For Lafley, design thinking was a way to get P&G to return to its roots as a company that pays attention to consumers. As I posted, he asked a long-time P&G employee, Claudia Kotchka, to create that capability and Kotchka got help in doing that by hiring an innovator from Mattel back in 2004 who created a process at P&G to solve tough business problems dubbed Clay Street.

As he explained in a March 7th interview, Kotchka lured David Kuehler, Director, P&G Integrated Innovation Capability, from Mattel’s (MAT) Project Platypus (PP). As described in a 2005 Business Week interview, PP took 12 employees with different skills and experience away from their jobs for three months and charged them with “conceiving and developing a completely new brand.” PP ran itself out of a separate 2,000 square foot building that “looks like a playground.”

As Keuhler explained, many companies came to visit PP — including P&G. When P&G was at PP, Keuhler observed that it was “the most committed to innovation and improvisation.” Ultimately, Kotchka persuaded Keuhler to start a similar activity at P&G which he did in 2004.

One of the first challenges Kuehler faced was what to call his new P&G project. As it happened, P&G made space for Kuehler’s new operation in an old brewery, “outside the berm of P&G,” on Clay Street, in a less-than-upscale part of Cincinnati.

It turned out that Lafley was on the board of a redevelopment commission for the area. After coming up with hundreds of naming options, Kuehler and Kotchka quickly agreed to name it Clay Street.

Clay Street achieved remarkable results quickly. According to Kuehler, Clay Street’s second session in 2004 helped revive a then-tired brand of shampoo,Herbal Essences. The cross-functional team that spent 10 to 12 weeks at Clay Street came up with ideas that boosted Herbal Essences’ so-called index — a measure of sales growth relative to year ago results — from 76 before Clay Street to 124 after.

The key insight that produced this astonishing result was that the team of P&G people responsible for the Herbal Essences makeover, based on the insights of a young intern, arrived at ”a very different idea of what the word organic means for today’s consumer, versus the meaning it had for older generations.”

For example, when asked to shop for items they considered organic, the P&G team selected “below the ground” products like herbal tea, health food and granola. By contrast, the Gen Y consumer’s theme was “all possibilities” – including items such as smoothies and brightly colored blouses.

From this insight, the P&G team created a new “equity” — e.g., the brand’s logo, color, shape and ”how it performs and what it stands for in the mind of the consumer.” Instead of the clear bottle with gooey dark green shampoo, the new version of the product features pink and other more subtly-colored opaque bottles and a tag line “Discover Pure Botanical Bliss.”

Clay Street’s approach is to transform the way that P&G traditionally operates. Its tradition is for brand development to be led by staff from the marketing function — they choose the brand’s advertising approach based on its benefit to the consumer.

P&G in the past has encouraged teams to focus on their specific functions. R&D comes up with a technology to deliver the benefit that the consumer wants. R&D hands off to Design and Package Development to create the package and Sales goes to the retailer and asks how many cases it wants to buy.

At Clay Street, Kuehler’s team tries to change this mind-set. In a 10 to 12 week session, Clay Street tries to create the feeling of working in a start-up. In that context, Clay Street gets team members to take off their functional hats and see how the product looks from the perspective of the consumer — and in so doing – to view their work in the context of the other functions.

The result of Clay Street is that people behave differently. For example, the person from marketing comes into the team feeling responsible for the outcome, but more willing to listen and be open about not knowing the answer.

R&D might work with marketing to help develop advertising copy. And Sales might come up with ideas for package design based on looking at competitors’ packaging. At Clay Street, team members are able to “bring their whole selves to the problem solving process, not just their functional expertise.”

How does Clay Street accomplish this transformation? Kuehler points out that a key element is giving the team a very clear goal and near-complete autonomy — rather than waiting for their bosses to provide direction. Clay Street also immerses them in new ways of thinking by bringing in speakers with different points of view on, say, sustainability. It also gives them “improv training” and shows them how to “leverage [the team's] collective genius.”

The final challenge for Clay Street is what happens to these teams after they re-enter P&G’s mainstream business. Without proper seasoning from Clay Street, such teams tend to lose their momentum.

So when it came to Herbal Essences, Clay Street worked with senior executives such as Susan Arnold, to encourage P&G to remove procedural barriers — such as dozens of meetings that P&G traditionally requires — that might slow down the implementation of the ideas that the team developed.

If P&G can keep the idea of Clay Street going, it will probably be alive and kicking 175 years from now.

Subscribe to:

Comments (Atom)